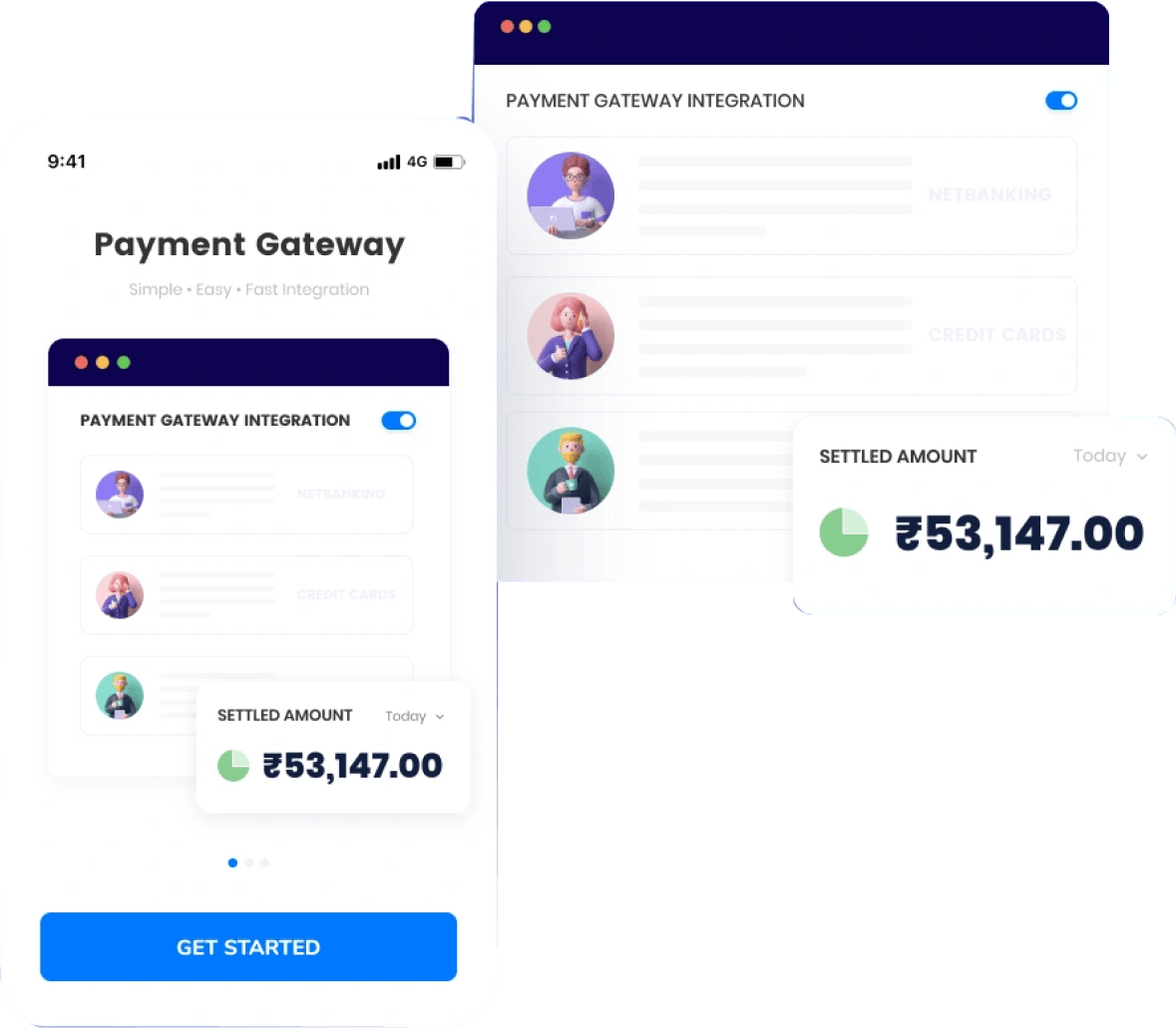

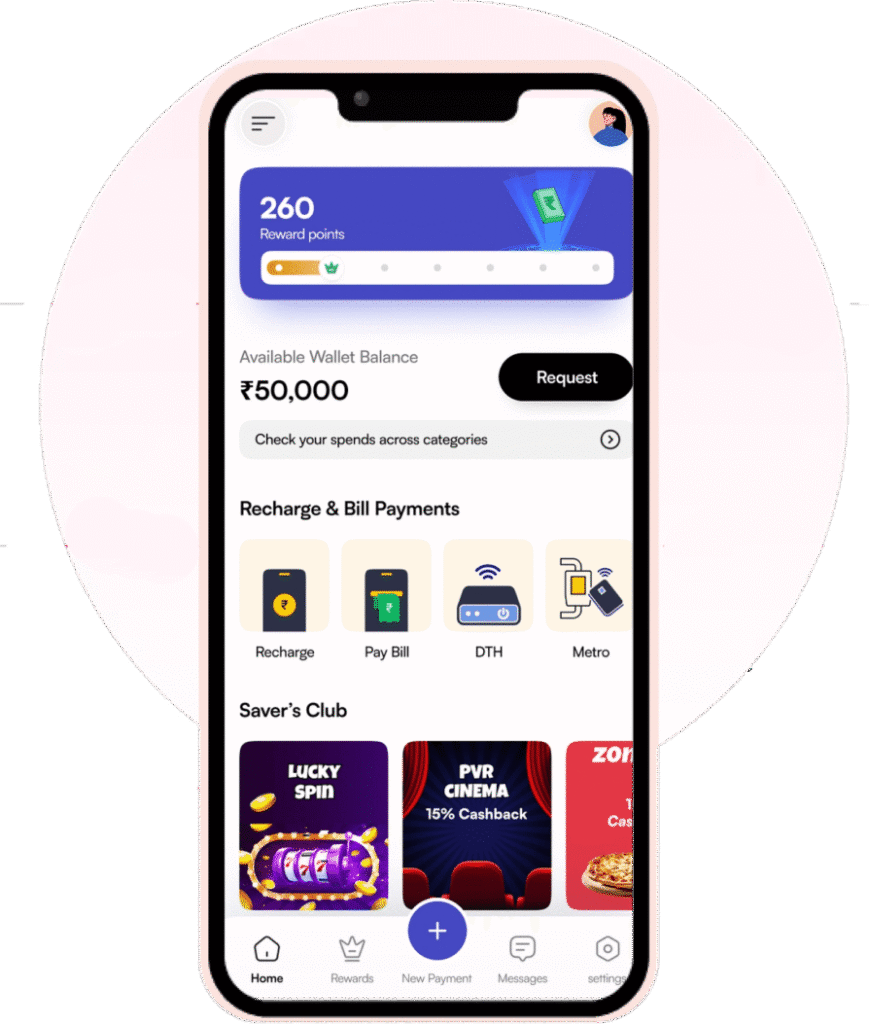

Enable Seamless, Secure, and Instant UPI Payments for Your Business. Power your mobile app or website with India’s most trusted payment method – Unified Payments Interface (UPI). From QR-based payments to UPI Intent and Deep Linking, Triple Minds offers end-to-end UPI integration tailored for both Android, iOS, and web apps.

We analyze your business model, user journey, and technical infrastructure to design a tailored UPI integration plan that aligns with your platform's growth and compliance needs.

From API integrations to custom UI/UX flows, our dev team ensures your UPI solution is fast, secure, scalable, and aligned with NPCI & RBI standards.

Once live, we help you market your UPI features to your end-users—be it merchants, partners, or customers—through targeted performance campaigns, SEO, and digital PR.

Enable Seamless, Secure, and Instant UPI Payments for Your Business. Power your mobile app or website with India’s most trusted payment method – Unified Payments Interface (UPI). From QR-based payments to UPI Intent and Deep Linking, Triple Minds offers end-to-end UPI integration tailored for both Android, iOS, and web apps.

Enable real-time fund transfers between users, vendors, and partners.

Save on MDR costs with zero transaction charges under UPI norms.

Google Pay, PhonePe, Paytm, BHIM, Razorpay, Cashfree, and more.

Compliant with NPCI & RBI protocols; supports tokenized payments and audit trails.

Get full reconciliation data with UTR, timestamps, and webhook support.

UPI (Unified Payments Interface) is not just revolutionizing payments in India—it’s going global. Now accepted in countries like Singapore, Australia, UAE, Mauritius, Nepal, and expanding into France, UPI is quickly becoming a preferred payment option for both domestic and international Indian customers. Whether you’re a startup, eCommerce business, or enterprise platform, integrating UPI ensures you stay ahead with fast, secure, and scalable transactions.

At Triple Minds, we're not merely developers; we're architects of digital brilliance, shaping your concepts into impactful reality.

At Triple Minds, we're not merely developers; we're architects of digital brilliance, shaping your concepts into impactful reality.

At Triple Minds, we're not merely developers; we're architects of digital brilliance, shaping your concepts into impactful reality.

At Triple Minds, we're not merely developers; we're architects of digital brilliance, shaping your concepts into impactful reality.

At Triple Minds, we're not merely developers; we're architects of digital brilliance, shaping your concepts into impactful reality.

At Triple Minds, we're not merely developers; we're architects of digital brilliance, shaping your concepts into impactful reality.

Enable seamless UPI payments using Google Pay’s Intent and Deep Link APIs. We support direct GPay flows for both Android apps and web redirects.

Integrate Paytm’s UPI and Wallet APIs for fast checkout, collect requests, and QR-based payments. Ideal for eCommerce, marketplaces, and fintech platforms.

Add BHIM compatibility to your app or website to reach rural and semi-urban users. We follow NPCI guidelines for stable BHIM-based UPI flows.

Connect your backend with direct UPI rails via PSP banks like ICICI, Axis, HDFC, and Yes Bank. We handle APIs, UAT, and compliance.

Offer static and dynamic UPI QR generation for real-time, one-scan payments. Great for offline-to-online payment scenarios and POS systems.

Enable payments using registered mobile numbers linked with UPI—no need to enter VPA manually. Simplifies user journey and reduces drop-offs.

Whether you’re building a fintech app, running a digital marketplace, or launching a SaaS product—Triple Minds offers end-to-end UPI development, integration, and compliance support to help you launch faster and scale with confidence.

At Triple Minds, we offer full-cycle UPI payment development and integration services designed to help Indian and global businesses enable fast, secure, and compliant UPI payments. Whether you’re building a new platform or integrating UPI into an existing app or website, we’ve got you covered.

Enable merchants and platforms to accept payments via custom UPI QR codes. We support dynamic QR generation with transaction-specific details.

Trigger collect requests to any UPI ID (VPA) with a structured pay-now interface. Ideal for service billing, subscription platforms, or custom apps.

Automate transaction matching and reconciliation using UTR, reference IDs, and webhook responses. Reduce manual tracking and operational errors.

Integrate with popular UPI PSPs and banks like Google Pay, PhonePe, Paytm, BHIM, Amazon Pay, ICICI, Axis, and more—all via a unified backend.

Setup and configure Android-based or traditional POS machines that support UPI payments via QR or mobile apps.

Triple Minds delivers custom UPI integration solutions for B2B platforms across industries—enabling real-time transactions, automated settlements, and enhanced customer experience.

Pay via UPI ID / VPA

QR Code Scanning (Static & Dynamic)

Collect Requests (Request-to-Pay via VPA)

UPI Deep Linking & UPI Intent Handling

Recurring Payment Support via UPI AutoPay (eMandates)

Push & Pull Transactions (Pay or Request Money)

Webhook & Push Notification Integration (for transaction status)

Real-Time Transaction Logs & Analytics

Failed Payment Detection & Retry Mechanism

Multi-PSP Routing Logic for better success rate

Custom UI/UX Payment Modals for Web & Mobile

Easy Integration SDKs/APIs for Android, iOS, React, Flutter, & web stacks

No matter what tech stack or platform your product runs on, Triple Minds ensures seamless UPI payment integration with optimized performance and secure workflows across mobile and web environments.

Android (UPI Intent + Deep Link + SDK)

iOS (Custom Flows using UPI URLs & Third-Party SDKs)

React Native & Flutter (Hybrid SDK Integration)

PWA (Progressive Web Apps) with UPI deep linking support

Whether you’re using plain HTML or complex frontend frameworks:

UPI Deep Linking from Web to Mobile Payment Apps

Auto-detect and redirect based on device & UPI apps installed

Dynamic QR Code Generation for Web Checkout

Cross-browser & mobile web compatibility

Integration with major PSPs & Gateways via APIs (PhonePe, Paytm, Razorpay, Cashfree, etc.)

To deliver a real-time, secure, and cross-platform emergency response app, we leveraged the following technologies.

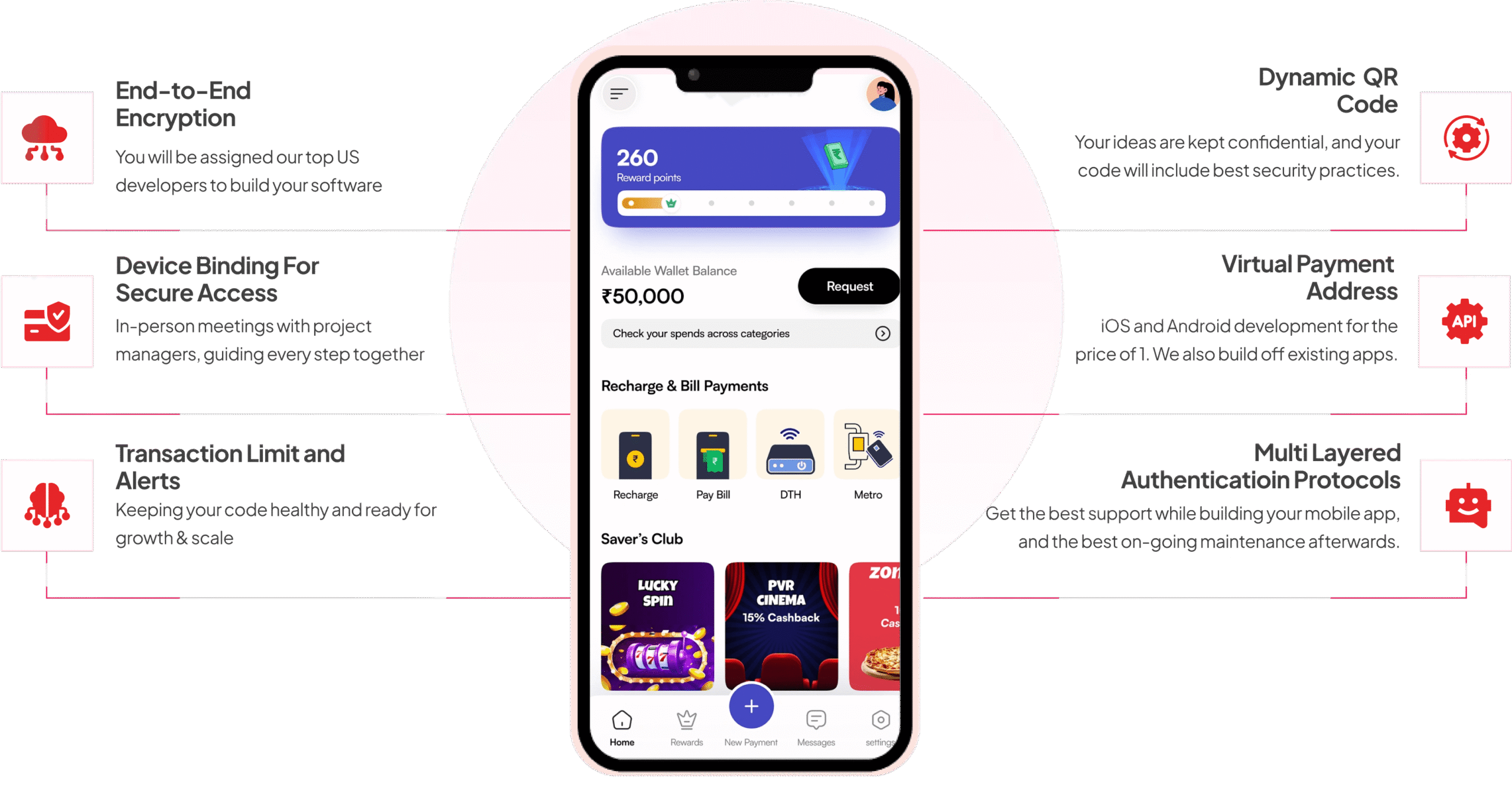

We implement UPI flows that adhere strictly to NPCI guidelines and RBI mandates for secure digital payments.

All payment data is encrypted using industry-standard TLS, AES, and tokenization techniques.

Backend APIs are structured with role-based access, rate-limiting, and session token validation.

UPI doesn’t require PCI-DSS, still we apply similar controls to safeguard user transaction logs.

Full visibility into transaction status, UTR, gateway responses, and reconciliation records.

Integrated mechanisms for velocity checks, duplicate detection, and real-time alerting.

The cost to develop a fully functional UPI app typically ranges between $8,000 to $12,000, depending on the features, UI/UX complexity, and backend architecture. This includes NPCI-compliant UPI API integration, multi-bank PSP routing, dynamic QR setup, webhook-based reconciliation, and robust transaction logging. Development covers Android, iOS, and web platforms, along with sandbox testing, security layer implementation (encryption, tokenization), and optional POS or merchant modules.

We also offer add-ons like UPI AutoPay (eMandates), admin dashboards, and analytics panels for enterprise-grade control. Our triple-phased approach ensures you get consultation, development, and go-to-market strategy—all under one roof.

We don’t just write code—we design smart payment experiences tailored to your platform’s structure. Here are typical UPI integration workflows we implement across different industries:

Outcome

Faster checkout, reduced cart abandonment, and instant order confirmation.

At Triple Minds, security is embedded at the core of every UPI integration. Whether you’re building a full-scale UPI app or adding UPI to your platform, we implement multiple security layers to protect user data, prevent fraud, and maintain trust.

You will be assigned our top US developers to build your software.

You will be assigned our top US developers to build your software.

You will be assigned our top US developers to build your software.

You will be assigned our top US developers to build your software.

You will be assigned our top US developers to build your software.

You will be assigned our top US developers to build your software.

UPI integration allows your app or website to send and receive payments directly using India’s most popular real-time payment system. It’s essential for platforms looking to offer seamless digital payments, reduce transaction costs, and expand their user base.

Yes. We offer custom UPI integration for Android, iOS, web apps (React, Angular, etc.), and backend systems using secure, NPCI-compliant APIs.

We integrate with all major UPI platforms including Google Pay, PhonePe, Paytm, BHIM, Amazon Pay, and support banks like ICICI, HDFC, Axis via third-party gateways such as Razorpay, Cashfree, and PayU.

Absolutely. All our integrations follow NPCI and RBI guidelines. We ensure encrypted transactions, secure token flows, and proper audit trails.

Typical UPI integration can be completed in 7–14 weeks, depending on your tech stack, compliance needs, and feature complexity.

End-to-end payments and financial management in a single solution. Meet the right platform to help realize.

With a team of experts in consulting, development, and marketing, we craft tailored strategies—just tell us your goal, and we’ll map a custom plan that fits your business needs.