Share your idea or what you need — We’ll get back at lightning speed

We’ve developed many digital masterpieces & helped businesses reach millions. Ask us on call to show demos & results.

An end-to-end auto finance software that helps you onboard borrowers faster, automate loan origination, manage EMIs, track vehicles, handle collections, and stay compliant — all from one secure platform. Built for car loans, bike loans, truck financing, fleet loans, and commercial vehicles, across single or multiple locations.

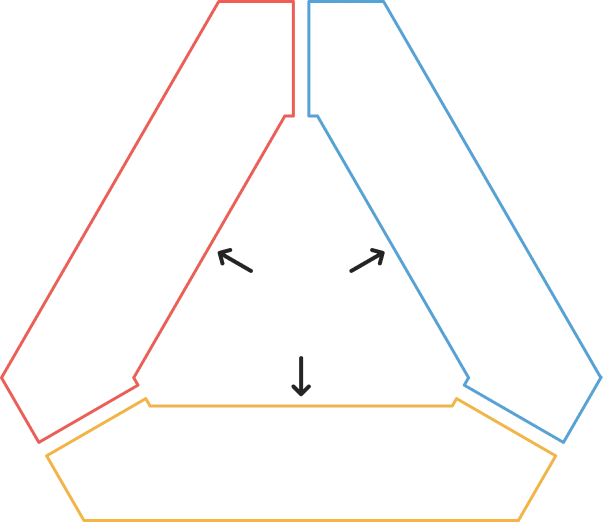

End-to-End Control Across the Entire Auto Loan Lifecycle

Faster Loan Processing With Automated Approval Workflows

Customizable Loan Rules That Match Your Business Model

Simple and Secure Customer Onboarding in Minutes

Dealer-Friendly Workflows Designed for Real Sales Operations

Centralized Document Management With Bank-Grade Security

Our auto loan management software is designed to support different lending models, vehicle types, and operational scales — from local dealerships to

global finance companies. Each workflow, rule, and feature adapts to how your lending business actually operates.

Our auto loan management software is built to handle the complete lending journey, from first application to final loan closure.

Each module works together, so your team never switches systems or loses data context.

Digitize the entire onboarding process with configurable workflows that match your lending rules. Capture customer details, upload documents, validate vehicle data, and approve loans faster — without manual back-and-forth.

Define eligibility rules, down payments, interest slabs, and approval logic based on your business model. Automate approvals for standard cases while keeping manual control for exceptions.

Manage fixed or floating interest rates, flexible EMI schedules, part-payments, foreclosures, and restructures. The system recalculates everything automatically and keeps balances accurate in real time.

Track vehicle details, RC status, hypothecation, lien marking, and regional DMV or RTO compliance. Keep all asset-related documentation linked directly to the loan record.

Automate reminders, track overdue accounts, manage promise-to-pay commitments, and support repossession or legal workflows. Reduce NPAs with structured follow-ups and real-time visibility.

Handle loan closures, generate NOCs, and maintain a complete audit trail. Access detailed reports for repayments, income, dealer settlements, and compliance reviews — ready when you need them.

Auto lending runs on documentation. Our secure auto lending document management system keeps every file organized, protected, and instantly accessible — without manual follow-ups or data risk.

All customer, vehicle, and loan documents are stored in one structured location and automatically linked to the correct loan record — no scattered files or missing paperwork.

Faster access, zero confusion, better control

Every document is protected with strong encryption, secure access layers, and controlled permissions to ensure sensitive customer and financial data stays safe.

Enterprise-level data protection and compliance

Control who can view, upload, download, or edit documents based on user roles. Sensitive files stay visible only to authorized personnel.

Reduced internal risk and cleaner audits

Track every document action — uploads, downloads, updates, and access history — with timestamps and user logs for full transparency.

Audit-ready documentation at all times

Upload documents from branches, dealer portals, mobile devices, or field collection apps. Everything syncs automatically to the central system.

Faster onboarding and smoother field operations

Our auto loan management software is designed to onboard customers quickly without compromising on accuracy or compliance. Every step is structured, automated, and easy for both your team and your customers.

Collect borrower information, vehicle data, and loan preferences through branch, dealer, or digital channels. All details are validated and stored securely from the start.

Attach KYC, income proofs, vehicle documents, and supporting files directly to the customer profile. Documents are organized automatically for quick review and approval.

Set loan amount, tenure, interest rate, and repayment preferences. The system instantly calculates EMI schedules with full transparency.

Approve the loan, activate the account, and begin real-time tracking of repayments, reminders, and balances — all from a single dashboard.

Schedule a live demo and see how our auto loan software adapts to your workflows, vehicle

types, and compliance needs — without changing how you operate.

Managing repayments should not depend on follow-ups, calls, or spreadsheets. Our auto loan management software automates collections, payment tracking, and recovery workflows, so you stay in control of cash flow while reducing operational stress. From regular EMI reminders to overdue handling and recovery actions, everything works in a structured, traceable system

Higher on-time collections, fewer follow-up calls

Early action on problem accounts before defaults grow

Higher on-time collections, fewer follow-up calls

Structured collections instead of guesswork

Controlled recovery with full traceability

Better decision-making and compliance readiness

Our Auto Loan Servicing Software starts at $2,500 USD — a one-time cost, not a recurring subscription. You get complete ownership, including the full source code, so there’s no vendor lock-in and no dependency on third-party platforms.

The final price depends on how advanced and customized you want your auto loan management system to be. Whether you need basic loan servicing or a fully tailored solution with custom workflows, integrations, and compliance rules, we build the platform around your exact lending model.

One-time pricing with lifetime ownership

Fully customizable auto loan management platform

Source code access and deployment control

6 months of free maintenance & AWS hosting

Clear delivery timeline (30–60 days)

No recurring license or usage fees

Our reporting and analytics layer is not just about numbers — it’s built to help lenders spot

risk early, improve collections, and scale smarter. Every insight is designed to answer real business questions in seconds.

As your auto lending business grows, managing loans alone is not enough. Many of our clients extend their operations using these additional

products and services — designed to improve efficiency, visibility, and customer experience.

Turn your loan, customer, and payment data into instant answers. Ask questions like “Which dealers have the highest defaults?” or “How much EMI is overdue this month?” — without reports or SQL.

Get instant insights without manual reporting

Reduce dependency on analysts

Make faster business decisions

From lead generation to brand visibility, we help auto lenders and dealers attract the right borrowers using SEO, paid ads, and performance marketing.

Generate high-quality loan leads

Reduce customer acquisition cos

Build long-term brand visibility

Automate customer support for loan status, EMI due dates, document requests, and FAQs — available 24/7 across website and WhatsApp.

Reduce support workload

Improve borrower experience

Respond instantly without manual effort

Launch a vehicle listing platform for new or used cars, bikes, or commercial vehicles — integrated with financing options.

Combine vehicle listings with financing

Attract more buyer traffic

Create an additional revenue stream

Manage sales agents, field collection teams, and dealer staff with role-based access, task tracking, and performance monitoring.

Improve team productivity

Track field operations in real time

Reduce operational leakage

We build custom workflows, third-party integrations, and internal tools tailored to your operations — from CRM to accounting and compliance systems.

Eliminate repetitive manual work

Connect all business systems

Scale operations without chaos

Book a live demo or consultation to discuss your lending model, required features, and customization needs. We’ll help you design an

auto loan management system that fits your operations today and scales with you tomorrow.

Yes. Our auto loan management software supports financing for cars, bikes, commercial vehicles, fleet assets, and multi-vehicle loans. The platform adapts to different vehicle types, loan structures, and business rules without requiring separate systems.

This is a one-time license, not a recurring subscription. You get full ownership of the software, including source code access. There are no monthly or yearly usage fees, giving you complete control and long-term cost savings.

Absolutely. Every auto lending business operates differently. We customize loan rules, onboarding flows, EMI logic, collections processes, and reports to match your exact business model and operational needs.

Security is built into every layer. The platform uses encrypted data storage, role-based access control, audit logs, and secure cloud hosting on AWS to protect customer, loan, and financial data.

Most implementations are completed within 30 to 60 days, depending on the level of customization and integrations required. We follow a structured development, testing, and deployment process to ensure a smooth launch.

Yes. We include 6 months of free maintenance and support after launch. Our team assists with updates, fixes, and guidance to ensure your auto loan management system runs smoothly as your business grows.