How Candy.ai Makes Money: Breaking Down Its Revenue Models

Candy.ai has crossed $25 million in annual recurring revenue by monetising AI companionship through subscriptions, affiliate-driven growth, and token-based add-ons. Here’s a detailed breakdown of its revenue model and earning strategy.

Published Date: July 19, 2025

Candy.ai has emerged as a standout success story. We are especially qualified to discuss Candy.ai’s business model, as we have worked with Candy.ai as a marketing partner, giving us insider insight into how this startup generates revenue. We’ve seen how Candyai really operates behind the scenes. For its detailed marketing strategy, visit our case study page.

Candy.ai came into the market in late 2023 and hit $25 million in annual recurring revenue within just a year. For a new player, that’s no small feat – it’s already matching what older names like Replika are pulling, even though Replika had 10 million downloads to get there. What this tells us is simple: Candy.ai figured out how to turn virtual companionship into serious money, fast.

In this article, we break down Candy.ai’s revenue models and explore how this AI startup makes money – from subscription earnings and affiliate marketing to other potential revenue streams – all in a detailed, business-focused analysis with real numbers.

Before we proceed, it’s important to highlight that we are the development partner of Sugarlab.ai – a NSFW chatbot that has already outscaled Candy.ai. And also a marketing partner of many NSFW Chatbots, so we possess insider insights on Candy.ai’s investment patterns, operational costs, and growth metrics – knowledge that gives us a strategic edge when analysing its revenue potential and market scalability.

As a Candy AI clone development company, we help startups and investors build platforms with the same revenue-driving model, features, and scalability that made Candy.ai a $25M ARR success.

Candy.ai at a Glance: Rapid Growth in the AI Companionship Market

Candy.ai is a Malta-based startup offering AI-powered virtual “girlfriends” – customizable AI companions capable of engaging in romantic or flirty conversations, including not-safe-for-work (NSFW) content. Launched around September 2023, the platform tapped into a booming “AI companion” trend and quickly attracted a paying user base. By the end of the 2024 financial year, Candy.ai’s annual recurring revenue had surpassed $25 million. Achieving such a run-rate within months of launch underscores Candy.ai’s explosive growth trajectory.

Revenue

This revenue performance is particularly striking when compared to older competitors. At Triple Minds, we have a qualified team of market researchers who, after conducting detailed research and analysing data from multiple statistics and industry sources, concluded these figures with accuracy. For example, Replika – one of the early AI friend apps – amassed over 10 million user downloads but earned roughly $25 million in revenue over eight months of 2024. Candy.ai matched that revenue level in a shorter time frame and likely with far fewer total users, indicating a higher revenue per user and an aggressive monetization strategy. Indeed, Candy.ai’s niche focus on fantasy romantic companions with adult content allows it to charge a premium and achieve better conversion rates from free to paid users.

As a result, Candy.ai’s growth has been both rapid and revenue-rich, making it a standout in the AI chatbot space. Industry analysts note that AI relationship apps are “raking in the moolah,” and Candy.ai’s quick $25M ARR success is often cited as evidence of how lucrative this market has become. It’s no surprise that venture investors are paying attention – ARK Investment Management predicts the AI companion industry could reach $150 billion annually by 2030, a huge opportunity that Candy.ai is poised to capitalize on.

The Candy.ai Business Model: An Overview

Candy.ai’s business model centers on a direct-to-consumer subscription service for its AI companion platform, supplemented by smart growth tactics and ancillary revenue streams. In essence, Candy.ai makes money by charging users for access to personalized virtual partners and premium features. Below is an overview of Candy.ai’s key revenue components:

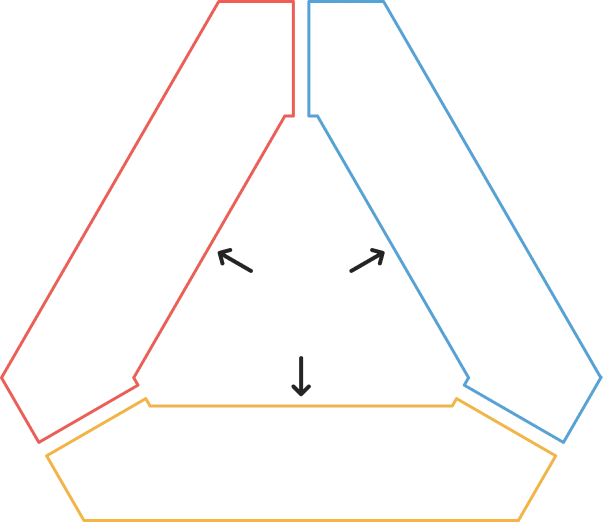

Candy.ai Business Model – Revenue Breakdown

Premium Subscription Fees:

The core of Candy.ai’s earnings comes from recurring subscription payments by users who want a full-featured AI companion experience. This includes unlimited chatting with AI “girlfriends,” customized personalities/avatars, image generation (including erotic visuals), voice interactions, and explicit content access. Candy.ai uses a freemium model – basic chat may be free or very limited, but meaningful interaction (especially NSFW content) is paywalled behind a premium plan. The subscription is often billed monthly or annually.

Affiliate Marketing Partnerships:

Candy.ai has rapidly grown its user base in part by leveraging affiliate marketers and referral partners. It offers generous commissions (a share of revenue) to marketing partners for each new paying subscriber they refer. This approach effectively turns affiliates into a sales force, fueling revenue growth while aligning costs with actual sales.

In-App Purchases (Token Packs):

In addition to standard subscription fees, Candy.ai monetizes add-on purchases. Subscribers receive a monthly allotment of “tokens” that can be used for generating special content (like AI-generated images or custom character enhancements). If users exhaust their monthly tokens, they have the option to buy additional token packs for a fee. This microtransaction model creates an extra revenue stream from power-users who want more content beyond the subscription’s included limits.

High Gross Margins (Digital Service):

Candy.ai operates as a cloud-based AI service, which inherently has high gross margins. There’s no physical product, and once the AI platform is developed, the cost of serving each additional user is relatively low (mostly cloud compute and maintenance costs). In fact, Candy.ai reportedly enjoys gross margins around 75%. This means a large portion of the subscription revenue turns into gross profit, contributing to healthy finances or funds that can be reinvested in R&D and marketing. High margins don’t directly “make money” for Candy.ai in the sense of revenue streams, but they indicate the business is very profitable on each dollar of sales.

No App Store Middleman:

A subtle but important aspect of Candy.ai’s model is that it primarily operates through its website rather than mobile app stores. By avoiding Apple’s App Store and Google Play for its transactions, Candy.ai circumvents the typical 15–30% commission those platforms take on in-app purchases. This means Candy.ai retains almost all the revenue from users instead of sharing with app marketplaces. Moreover, distributing via the web allows Candy.ai to offer adult content freely (which might be restricted on mainstream app platforms). In business terms, this approach improves Candy.ai’s net revenue per user and gives the company more control over payment and content policies.

In summary, Candy.ai’s business model is a subscription-based SaaS (Software-as-a-Service) model tailored to AI companions, augmented by affiliate-driven marketing and optional in-app purchase revenue. Next, we’ll break down these revenue streams in detail and even run some numbers to see how they contribute to Candy.ai’s income.

Revenue Stream #1: Premium Subscriptions (The Core of Candy.ai’s Earnings)

Paid subscriptions are the primary revenue engine for Candy.ai. Users pay a recurring fee – either monthly or annually – to unlock Candy.ai’s full suite of features and content. Let’s examine how these subscriptions are structured and why they’re so lucrative:

Candy.ai Premium Subscriptions – Revenue Breakdown

| Plan Type | Price | Estimated Users | Annual Revenue | Contribution to ARR |

|---|---|---|---|---|

| Monthly Subscription | $12.99 / month | ~120,000 | $18.7M | ~75% |

| Annual Subscription | $5.99 / month (billed annually) | ~80,000 | $5.8M | ~25% |

| Total Premium Subscriptions | – | ~200,000 | $24.5M | 100% |

Pricing Plans:

Candy.ai typically charges around $12.99 a month, or about $5.99 per month if users pay annually – roughly $72 a year. Initially, it was $99 per year, but they dropped prices and even rolled out a 75% discount to pull in new users. That brings the cost down to about $3.25 a month, which is a no-brainer for anyone curious to try it. The smart part? They lock in that discounted rate for as long as the user stays subscribed, which keeps churn low and retention high.

Value Proposition:

So, what does someone actually get when they pay? With Candy.ai’s premium plan, users build a fully tailored AI companion – looks, personality, everything. They can chat without limits, unlock roleplay features free users can’t touch, and get 100 tokens a month to generate custom images of their virtual partner. On top of that, they can start voice calls and, in some cases, even video interactions. In short, the subscription gives people a 24/7, personalized AI partner – and that’s exactly why users don’t mind paying for it.

User Conversion and ARR:

Candy.ai’s real money-making edge is how well it converts free users into paying ones. With $25 million in annual recurring revenue, here’s the math: at roughly $100 per year per user, that’s around 250,000 paying customers. If a big chunk grabbed the 75% discount, paying closer to $36 a year, we’re talking 700,000+ subscribers. Realistically, it’s somewhere in between. Either way, we’re looking at hundreds of thousands of people paying – which shows just how strong their subscription model really is.

Recurring Revenue and Retention:

What makes Candy.ai’s subscription money so powerful is that it’s steady and repeatable. They know a big share of users will keep renewing every month or year, which means predictable cash flow and strong lifetime value per customer. If the content keeps users emotionally hooked, they’ll happily stay for months. Even at a discounted $3–6 per month, one loyal user brings in $36–$72 a year. Scale that to tens of thousands, and it stacks up fast. In fact, Candy.ai pulled in $1.1 million in its first three months, showing both stickiness and word-of-mouth growth. Plus, with 75% gross margins, most of that revenue goes straight to covering costs or profit.

In short, Candy.ai’s earnings are driven by the scale of its subscriber base and the subscription fees each user pays. By offering a compelling product (AI girlfriends that feel “real” and intimate) at a price many find worth it, Candy.ai has built a steady stream of recurring revenue. The strategy of lowering the entry price via discounts may reduce short-term revenue per user, but it dramatically boosts sign-ups and long-term revenue potential through retention. It’s a classic tactic in SaaS growth – get users in the door with a deal and focus on keeping them for the long haul.

Calculations with Example:

To illustrate the power of this model, consider if Candy.ai has 300,000 subscribers paying an average of $8 per month (some monthly, some annual averaged out). That’s $2.4 million in monthly revenue, or about $28.8 million in annualized revenue – in line with the reported ARR. If Candy.ai continues adding users or upselling existing ones on longer plans, the ARR could grow substantially year over year. This recurring income is what makes the company’s valuation as a startup potentially sky-high, because investors love predictable subscription revenues.

Revenue Stream #2: Affiliate Marketing and Partnerships (Fueling Growth)

Aside from direct user payments, Candy.ai leverages affiliate marketing as a key part of its revenue strategy. While affiliate programs are technically a marketing expense (Candy.ai pays commissions to others), they directly contribute to revenue growth by bringing in many new paying customers that Candy.ai might not reach on its own. Here’s how it works and why it matters:

Generous Commission Structure:

Candy.ai offers affiliate partners a generous commission on sales – reportedly as high as 40% lifetime revenue share for each subscription referred. This means if an affiliate marketer (such as a blogger, influencer, or advertising partner) convinces someone to subscribe to Candy.ai through their unique link, that affiliate earns 40% of that user’s spending for the life of the customer. Alternatively, affiliates can opt for a one-time $30 payout per sale instead. Both options are quite attractive, considering Candy.ai’s subscription price. For example, 40% of a $72 annual plan is about $29, nearly equivalent to the flat $30 option. A 40% recurring cut is unusually high in affiliate programs (many software affiliates pay 10–30%), indicating Candy.ai is aggressively incentivizing partners to promote the service.

Affiliate Partners as Revenue Multipliers:

This strategy essentially turns many independent marketers into a distributed sales force for Candy.ai. Content creators on YouTube, tech bloggers, “AI girlfriend” review sites, and even media outlets can earn money by referring their audience to Candy.ai. The affiliate model drives revenue because it brings in paying users that Candy.ai might not have acquired through organic search or ads alone. Candy.ai only pays the commission if a user actually spends money, so it’s a performance-based cost of acquisition. This keeps Candy.ai’s marketing efficient – no dollars wasted on ads that don’t convert. As a result, Candy.ai likely scaled up to that $25M ARR rapidly by enlisting affiliates who tapped into niche communities (such as online dating forums, anime and roleplay communities, loneliness support groups, etc.) and directed interested users to Candy.ai.

Global Reach without Big Ad Spend:

Affiliates have helped Candy.ai reach global audiences. Because the program is available globally, marketers in any region can promote Candy.ai. This is important for revenue because the demand for AI companions isn’t limited to one country; there’s a worldwide market of users seeking virtual companionship.

By using revenue sharing instead of large upfront ad campaigns, Candy.ai contained its marketing costs relative to the revenue gained. In business terms, affiliates improved Candy.ai’s customer acquisition cost (CAC) dynamics, likely keeping CAC lower than the customer lifetime value (LTV). A healthy LTV/CAC ratio (often well above 3:1 in subscription businesses) means Candy.ai makes a strong profit on each customer over time.

The 40% commission eats into the first year’s revenue from a referred user, but if that user stays beyond roughly 2.5 years, Candy.ai recoups the remaining 60% in subsequent years entirely. And if many users come directly (non-affiliate, e.g., through press or word-of-mouth), those are 100% margin customers from day one.

In summary, affiliate marketing isn’t a separate “revenue stream” paid by users, but rather a growth strategy that boosts Candy.ai’s subscription revenue. It’s worth highlighting as part of the revenue model because Candy.ai’s quick rise to $25M ARR is in large part due to this partnership approach. By aligning the incentives of marketers with its own success, Candy.ai rapidly grew its paying user base, which in turn drives its top-line revenue. This approach underscores how innovative go-to-market tactics can be just as important as product features in a startup’s financial success.

Revenue Stream #3: In-App Purchases and Token Economy

While subscriptions cover the all-you-can-chat access to Candy.ai’s core features, the platform also makes money through in-app purchases, specifically via a token-based economy for premium content generation. Even after a user subscribes, there are opportunities for Candy.ai to earn more from them if they desire extra services:

Monthly Token Allotment:

A Candy.ai subscription comes with a package of tokens (for example, 100 tokens per month) included in the price. Users can spend these tokens to generate AI images of their virtual companion, create new customized characters, or possibly engage in other resource-intensive tasks (like long-form erotic stories or voice minutes, depending on how the service is structured). These tokens ensure that heavy usage of computationally expensive features is metered.

Purchasing Extra Tokens:

If users run out of their monthly token allotment due to high usage, Candy.ai provides the option to buy additional tokens as an in-app purchase. This is a classic freemium-style upsell: casual users are satisfied with the included tokens, whereas power users who want more images or faster interaction can pay extra. For instance, if 100 tokens typically allow generation of, say, 20 images, an enthusiast user might want 200 images – they would need to purchase more tokens to fulfill that desire. The pricing of token packs isn’t listed in our sources, but it’s likely scaled (e.g., $5 for X tokens, $10 for Y tokens, etc.). These microtransactions can significantly boost revenue given a sufficiently large user base, and they monetize the most engaged users beyond their subscription fee.

Example Calculation:

Suppose out of Candy.ai’s subscribers, 10% regularly buy extra tokens each month, spending an average of $5 extra. If Candy.ai has ~250,000 subscribers, that’s 25,000 users buying tokens monthly. At $5 each, that’s about $125,000 per month additional revenue, or $1.5 million a year – a non-trivial 6% bump to ARR. If the uptake is higher or token packs more expensive, the contribution grows. This revenue is additive on top of subscriptions and comes at high margin (since it’s purely digital goods). Thus, even a small fraction of users indulging in extra purchases can meaningfully increase Candy.ai’s total revenue.

Future Expansion of Virtual Goods:

Candy.ai could expand its in-app offerings over time. This might include things like virtual gifts (imagine buying a virtual ring or bouquet for your AI girlfriend), special events or scenarios that cost tokens to unlock, or even premium AI model upgrades (pay to access an even more advanced AI personality). These are hypothetical, but many gaming and social apps use such techniques. Given Candy.ai’s romantic angle, there’s ample creative room to introduce paid extras that enhance the emotional experience (for example, a Valentine’s Day special interaction that costs a few dollars). Such features would deepen engagement (keeping users subscribed) and provide one-off revenue boosts.

In summary, the token-based in-app purchases ensure that Candy.ai maximizes revenue from its most engaged fans without alienating casual users. Everyone pays the base subscription, but those who derive exceptional value and want more can spend more. This tiered monetization approach is a smart way to increase ARPU (Average Revenue Per User) and has likely contributed to Candy.ai’s strong revenue performance.

Candy.ai’s Growth Strategy and Startup Trajectory

Candy.ai’s monetization cannot be separated from its overall startup business strategy. The company’s journey and how it’s financed/growing are relevant to understanding its revenue model’s sustainability and potential:

Founding and Team:

Candy.ai was co-founded by Alexis Soulopoulos, an Australian tech entrepreneur known for previously leading Mad Paws (an ASX-listed pet services startup). Candy.ai’s corporate registration is in Malta, and interestingly, the founders initially kept a low profile – even listing placeholder names on startup directories. This might be due to the sensitive nature of an NSFW-oriented business. However, having an experienced founder likely gave Candy.ai a solid foundation in operations and strategy. Soulopoulos’ background and possibly some seed capital (from prior ventures or angel investors) could have funded the initial development of the platform. No major venture capital funding has been publicly announced for Candy.ai as of 2024, which suggests the company scaled primarily through revenues (and possibly modest angel investment). In fact, Candy.ai became profitable within its first three months, generating about $1.1 million in revenue with healthy margins. This is a rare case of a tech startup achieving positive cash flow so early – a sign that the revenue model is fundamentally strong.

Startup Growth vs. Competitors:

The AI companion space is heating up, and Candy.ai’s growth is happening alongside other startups. For instance, Character.AI (a platform for various AI characters, not all romantic) reached 25 million users and secured a $2.7 billion investment from Google in 2024, highlighting how investors value this sector. Replika, while a bit older, had significant venture backing in its early days and grew its user base to millions. Candy.ai, despite not (yet) raising such high-profile funding, proved that revenue can be rapidly earned with the right product-market fit. If Candy.ai continues on this trajectory, it could very well attract large investments or even acquisitions in the future. The fact that it hit an ARR of $25M so quickly means Candy.ai could be on track to become a “unicorn” startup (valued at over $1 billion) if growth continues, given typical software revenue multiples.

Regulatory and Market Position:

Being based in Malta likely provides Candy.ai some regulatory flexibility (Malta has been known to be tech startup friendly). Candy.ai also sidestepped strict app store content rules by staying web-based, which gave it an edge to provide services that Replika or Character.AI (which had to censor adult content due to platform policies) couldn’t. This bold positioning helped Candy.ai carve out a lucrative niche of users specifically seeking uncensored AI relationships, translating into strong willingness to pay. By 2024, Candy.ai and a handful of similar services effectively created an AI girlfriend/boyfriend market segment that is growing fast. There were over 100 million downloads of romantic chatbot apps worldwide by late 2024, and Candy.ai positioned itself at the high end of monetization within that pie. It’s telling that AI relationship apps collectively have gained massive traction – Replika’s multi-million user base, numerous new startups (Urvashi in India, SoulGen, DreamGF, etc.), and even physical AI companion devices (like the FRIEND pendant) show this is not a fad. Candy.ai’s revenue model, focused on recurring spend, puts it in a strong spot to capitalize on this trend financially.

Investor Outlook:

Investors in the tech community have taken notice of Candy.ai’s early success, even if the company hasn’t publicly raised large rounds yet. The projected $150 billion market size by 2030 for AI companionship suggests that Candy.ai could scale its revenues by orders of magnitude if it executes well. One can imagine venture capital interest growing – likely Candy.ai would be able to raise funding at a high valuation to accelerate growth (e.g., for more advanced AI development, marketing, or even branching into new products like AI friend for different niches). However, Candy.ai’s leadership might choose to continue bootstrapping with customer revenue, since the business is already generating cash. Either way, the strong revenue model gives Candy.ai strategic options: grow organically and remain independent/profitable, or take on investment to capture market share faster. From a business standpoint, it’s a good problem to have when your product essentially funds its own growth through revenue!

Other Potential Revenue Models for Candy.ai’s Future

Candy.ai’s current revenue streams (subscriptions, affiliate-driven growth, in-app purchases) have proven highly effective. That said, as a forward-looking business, Candy.ai could explore additional revenue models or enhancements to keep growing and diversify its income. Here are a few possibilities that Candy.ai (or similar startups in this space) could integrate:

Tiered Premium Services:

Introduce higher-priced subscription tiers for super-fans. For example, a “Platinum” membership might cost more per month but offer perks like multiple AI companions at once, faster AI response (priority server access), extended voice or video call minutes, or even early access to new features and AI models. This kind of upsell can increase ARPU by capturing extra value from the most dedicated users.

One-Time Purchases or Premium Content Packs:

Beyond the monthly token system, Candy.ai could sell special one-off content packs. Imagine seasonal or themed experiences with your AI partner (e.g., a “Virtual Vacation” package where the AI sends you stories and images as if you two are on a trip, available for a fee). Or a custom avatar artwork commission from Candy.ai’s design team for your AI (a personalized touch for, say, $50). These one-time purchases would add incremental revenue and keep users engaged with fresh content.

Advertising Partnerships (Selective):

Currently, Candy.ai likely does not show ads to users (as it would detract from the intimate experience). However, there is potential for indirect advertising or partnerships. For instance, Candy.ai could partner with brands in relevant industries (like dating services, self-care products, or entertainment media) for sponsored content that doesn’t feel intrusive. Perhaps a movie studio could pay to have Candy.ai offer a special interaction where your AI girlfriend takes on the persona of a character from an upcoming romance film – effectively a paid promotion that users might even enjoy. This must be handled carefully, but creative partnerships could yield revenue without traditional banner ads.

Licensing and B2B SaaS:

If Candy.ai develops proprietary AI technology (for conversations, image generation, etc.), it could license its AI platform to other businesses. For example, a mental health app might want a “friend chatbot” feature – Candy.ai could provide a censored version of its AI for a fee. Or international partners might license Candy.ai’s platform to launch region-specific companion apps (localized languages, culturally tailored AIs) – Candy.ai could earn royalties or licensing fees from such deals. This would turn Candy.ai’s tech into a B2B (business-to-business) revenue source alongside the B2C subscriptions.

Extended Reality Experiences:

As AR/VR technology matures, Candy.ai could venture into virtual reality or augmented reality companions. They might sell a VR companion experience or even hardware tie-ins (imagine an AR hologram girlfriend you see through smart glasses). These could be sold as premium products or subscriptions at higher price points. While more futuristic, it’s a natural extension as many users would pay more for a more immersive experience with their AI partner.

Community and Social Features:

Candy.ai could explore monetizing community features. For instance, if users could have joint experiences or group chats (in character) or share their custom AI characters with others, Candy.ai might implement a marketplace where users trade or sell AI persona profiles, with Candy.ai taking a cut of transactions. Another idea is an avatar fashion store – dressing up your AI avatar with outfits, each costing tokens or small fees. This borrows from gaming microtransaction models and could become a fun additional revenue stream.

It’s worth noting that Candy.ai must balance revenue expansion with user experience. The core appeal is the personal, emotional connection; any new monetization should not break the illusion or trust. However, done tastefully, these additional models could significantly boost Candy.ai’s earnings and keep the company’s growth momentum strong.

Conclusion: Candy.ai’s Revenue Engine and Growth Outlook

Candy.ai’s success in making money boils down to executing a smart, multifaceted revenue model in a new, high-growth market. The company generates revenue primarily through recurring subscriptions, charging users for the unique experience of an AI companion. It augmented this with clever strategies like an affiliate program to rapidly scale its paying user base, and by incorporating in-app purchases (token-based extras) to increase spending from its most engaged customers. By keeping distribution direct via the web, Candy.ai maximizes each dollar of revenue (avoiding app store fees) and maintains control over its content and pricing. The result is a startup that shot to $25 million+ in ARR in essentially its first year – a level of revenue growth that many consumer apps take much longer to achieve.

From a business perspective, Candy.ai exemplifies how tapping into a powerful user need – in this case, companionship and intimacy, delivered by AI – can translate into significant willingness to pay. The platform’s earnings are underpinned by strong unit economics: high gross margins (around 75%), scalable technology, and a subscription model that yields predictable cash flow. Candy.ai has also benefited from timing, launching when AI chatbots became mainstream and carving out a profitable niche of uncensored virtual relationships that competitors were hesitant to fully embrace.

Looking ahead, Candy.ai is positioned to continue growing its revenue. The broader AI companion market is projected to reach tens of billions of dollars in the coming years, and Candy.ai has an early mover advantage among “AI girlfriend” services. If the company reinvests its profits into improving AI realism, user experience, and marketing, it could dramatically increase its subscriber count and ARR. There’s also the potential of external funding or partnerships to supercharge growth – given Candy.ai’s traction, investors surely have eyes on it.

In conclusion

Candy.ai makes money by combining the tried-and-true subscription software model with the viral appeal of AI-driven relationships. Its revenue models – from premium plans to affiliate-fueled expansion and microtransactions – have proven effective, as evidenced by the impressive $25M ARR milestone and the company’s swift profitability. As a marketing partner of Candy.ai, we’ve seen first-hand how these revenue streams come together to create a sustainable, thriving business. With continued innovation, customer focus, and strategic expansion of its monetization methods, Candy.ai can not only maintain its revenue growth but potentially redefine what a successful AI startup looks like in the modern era. The lesson from Candy.ai’s rise is clear: solving human needs in novel ways, and structuring your business model to capture the value you create, is a recipe for both helping people and building a lucrative venture. Candy.ai appears to be doing both – and cashing in sweetly (pun intended) on the future of AI companionship.

Table of Content

- Candy.ai at a Glance: Rapid Growth in the…

- The Candy.ai Business Model: An Overview

- Revenue Stream #1: Premium Subscriptions (The Core of…

- Calculations with Example:

- Revenue Stream #2: Affiliate Marketing and Partnerships (Fueling…

- Revenue Stream #3: In-App Purchases and Token Economy

- Candy.ai’s Growth Strategy and Startup Trajectory

- Other Potential Revenue Models for Candy.ai’s Future

- Conclusion: Candy.ai’s Revenue Engine and Growth Outlook

- In conclusion